Responsible investments

At Simplicity, responsible invesments and sustainability are important parts of our asset management.

Our work as responsible asset managers

Our investment philosophy is to invest in sustainable and well managed companies. According to us these criteria are essential to deliver good risk adjusted returns to our clients. One of the key factors is that the companies we choose to invest in conduct their businesses in a responsible and sustainable manner. Simply put, we wish to create value without destroying the world. The board of directors at Simplicity have established a Policy for responsible investments and a Policy for owner involvement. These guidelines set the framework for how Simplicity incorporates responsible investments in its investment processes.

Identification of negative consequences for sustainable development

Investments in fund units entails exposure of the underlying assets and in turn exposure to the underlying companies’ activities for the investor. The possibly negative consequences for sustainable developments are thereby linked to the activities of the underlying companies. A key element of integrating sustainability risks is therefore to identify the possibly negative consequences for sustainable developments the investments may bring. Simplicity’s analysis starts by assessing risks and possibilities within specific sectors and specific companies´ alike. The company specific risks are assessed in relation to their overall impact on the company´s total operations, the probability that such event could take place, and the economic consequences if such events, etcetera. The potential sustainability risks vary by fund. The majority of Simplicity’s investments are in the Nordic region, and Simplicity has assessed that the major, general, sustainability risks are linked to various environmental risks.

Measures to manage sustainability risks

Simplicity works actively to assess and ensure that sustainability risks in the funds are well-balanced. This can, for example, be achieved by measuring the portfolios´ carbon footprint or by identifying the single companies which carry the greatest sustainability linked risks, and if needed adapt the portfolio structure to reduce the risks by re-weighting the portfolio holdings.

Simplicity works as a responsible asset manager through a combination of three different methods: exclusion, inclusion, and influence.

We exclude

Simplicity have identified several sectors which are ethically controversial or due to other reasons, as we see it, are deemed to have a negative contribution towards a sustainable society. Simplicity have chosen to not invest in the following sectors:

- Alcohol

- Tobacco

- Pornography

- Weapons

- Gambling

- Companies that extract fossil fuels, and other companies within the GICS sector 10 classification.

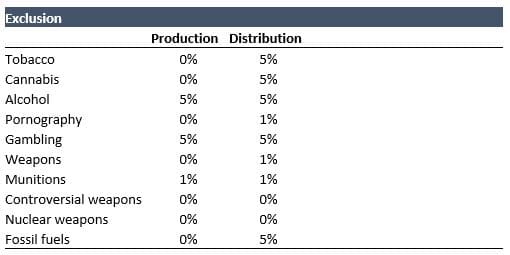

Sometimes these exclusion criteria can generate questions regarding how they should be interpreted. One example is a retail store that sells tobacco and alcoholic beverages. We therefore apply certain limits where accepted percentages of overall revenue is used as a yardstick according to below table:

In addition, companies with large fossil reserves, companies with more than 25 % of their energy production based on fossil fuels and companies with other types of business that are the main owners of companies in any of the above-mentioned industries are also excluded. More information on how each fund works with sustainability risks can be found in each fund’s prospectus.

We include

Simplicity actively seeks investment opportunities that, by their nature, make a positive contribution to a more sustainable society. This can be companies which through their operations contribute positively to a sustainable transition, but it can also be specific securities whose characteristics are specific to the area of sustainability. For Simplicity, the areas that are relevant to the funds’ investment scope can mainly be divided into the following main categories:

- Green, social, or sustainable bonds, and Sustainability Linked Bonds.

Green, social, sustainable bonds and Sustainability Linked Bonds have certain terms that stipulate how the money raised via such bonds may only be used for projects deemed to have positive effects in any of these areas. At least five percent of the assets under management in fixed income funds managed by Simplicity must be invested in these types of bonds.

- Companies that contribute to a sustainable transformation

Some companies actively contribute to sustainable transformation via their operations. Examples are companies that already today are adapted to a sustainable society, or companies that actively are changing their operations to reduce negative effects. An example of this could be a power supply company whose energy production is largely based on renewable energy sources. Another example could be a transport company that carries out an electrification of its vehicle fleet. These types of companies must be prioritized in company selection and portfolio weighting.

We influence

Company dialogues are initiated to influence and encourage companies to carry out their operations more sustainably. Company dialogues can be divided into two categories: reactive and proactive. Reactive dialogues are initiated when an incident or similar has occurred. If a company in which any of Simplicity’s funds are invested have breached any international norms and conventions our fund managers are obliged to initiate dialogues with the company. Our fund managers may also initiate dialogues proactively, either on their own or in collaboration with other investors. When company dialogues are prioritized fund managers should assess the likelihood of positive change as well as if there are increased sustainability linked risks.

As part of our impact work, Simplicity has signed the Business Benchmark on Farm Animal Welfare (BBFAW) – Global Investor Collaboration. BBFAW works for increased measurability, better conditions and increased transparency in the food industry and its value chains. Through their commitment, the pressure on companies in the sector to conduct their operations in a dignified manner increases. Read more about BBFAW on their website www.bbfaw.com.

Simplicity has also joined the Tobacco Free Portfolios, an initiative to reduce financial flows to the tobacco industry. Tobacco Free Portfolio’s vision is a world completely free from tobacco. Read more about Tobacco Free Portfolios on their website www.tobaccofreeportfolios.org.

The Global Goals

In 2015, world leaders agreed to 17 goals for a better world by 2030. These goals are to end poverty, fight inequality, promote peace and stop climate change.

Simplicity have chosen to focus on the goals for which we, through our investments, have the best chance to influence companies in a more sustainable direction. These goals are:

Number seven “Sustainable energy for all”

Number nine “Sustainable industry, innovation and infrastructure”

Number eleven “Sustainable cities and communities”

Number thirteen “Climate action”

Number seventeen “Partnerships for the goals”

We believe that we can contribute in a positive way by investing in companies that can help achieve the above stated goals, by for example investing in Green Bonds or in companies that makes the transit into future energy sources possible. We also seek to accomplish these goals in collaboration with other companies and investors via, for example, investor collaborations. You can learn more about The Global Goals at UNDP´s website www.globalgoals.org.

Sustainability committee

To address current questions and topics Simplicity has an internal sustainability committee which meet regularly. The sustainability committee is composed of all fund managers together with at least one representative from each other department at Simplicity. The committee´s role is to advise on how certain questions and incidents should be handled, which companies to exclude, which companies to influence, etc.

UNPRI

Simplicity is a signatory of the UNPRI, the UN supported principles for responsible investments. UNPRI works to increase the understanding of responsible and sustainable investments. The foundation of UNPRI are six non-binding principles that incorporates what is expected of the signatories. By implementing them, signatories contribute to developing a more sustainable global financial system. Globally there are more than 7000 signatories from over 135 countries.

UNPRIS:s six principles for responsible investments

Principle 1. We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2. We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3. We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4. We will promote acceptance and implementation of the principles within the investment industry.

Principle 5. We will work together to enhance our effectiveness in implementing the principles.

Principle 6. We will each year report on our activities and progress towards implementing the principles.

Learn more about UNPRI at their website www.unpri.org.

SWESIF

Simplicity has also joined SWESIF (Sweden’s Sustainable Investment Forum) and their sustainability profile. SWESIF is an independent network forum for sustainable investment organizations in Sweden. In the sustainability profile, fund companies indicate the sustainability criteria that are included in the management of a fund, which facilitates comparisons between different funds for investors. The decision to accede to SWESIF is based on our continued work towards increased integration of sustainability and responsibility in our investment process.

Code of conduct for responsible entrepreneurship and international standards

Simplicity shall act as a responsible corporation. The company has adopted Ethical guidelines that dictate how ethical questions should be processed within the company. Simplicity shall follow the UN Global Compact guidelines and through its products as well as other operations contribute to reaching the goals agreed in the Paris agreement.